The recent welcome slowdown of inflation in Iran, like its devastating acceleration four years ago, has something to do with global influences that are well beyond Iran’s control. The credit in the current slowdown in inflation goes in large part to Rouhani’s economic team but what Iran’s economy minister, Mr. Tayyebnia, has called a “miracle”, has earthly reasons that are not even under the control of Iranian policy makers. Not realizing these influences can be misleading.

Two important sources of inflation in Iran are the price of oil and food. But for different reasons. The influence of international food prices is obvious, because Iran is a major importer of foodstuffs. But how oil causes inflation in Iran is less obvious because it is an export commodity. The way the latter mechanism works is that expenditure of oil revenues causes not-traceable prices in Iran to rise. This is the so-called real appreciation that requires the relative price of non-tradable to tradable goods to increase. Of course, this can occur if prices are fully flexible, but that is a fairy tale people tell when they want to blame everything on the growth of money supply. The truth is that money supply has to grow to accommodate the change in relative prices through differential increase in the price of tradable and non-tradable goods.

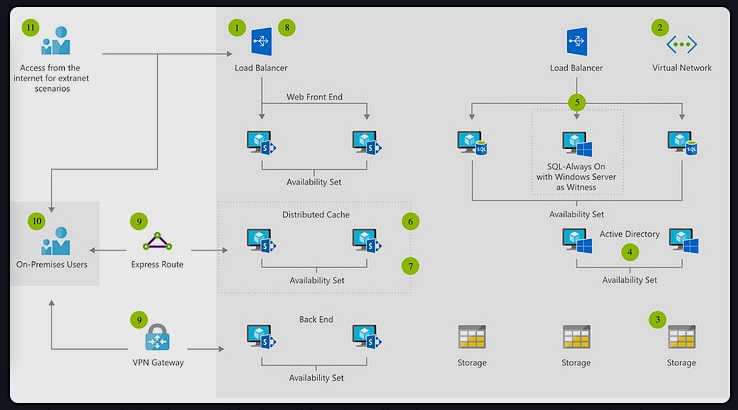

Added to this is that commodity prices often move together, so increases in the price of oil often coincide with food prices increase. (Why this is the case is beyond my expertise, but you can read about it in Hochman et al, American Economic Review, May 2010. Perhaps higher oil prices raise the cost of fertilizer and food, but other forces may have been pushing both prices up.) The chart below shows the close movement of food and oil prices since 1990. The soft oil market in the 1990s was coincident with stable or falling index of food prices. As oil started its rise, which stopped (ended?) a few months ago, food prices increased rapidly. These prices continued to move together after the banking crisis of 2008 which led to a brief collapse of oil prices in 2008.

Figure 1. Price of oil and food move closely together

Note: Food price is the FAO index, and oil is in USD per barrel.

And now look at how Iran’s inflation rate has behaved since 1998, the period after the price of oil bottomed out in 1998. You can see in this chart clearly that there is a relationship between Iran’s inflation rate and the two commodity series. Inflation picks up in earnest as oil revenues kick up in 2004 and food prices start their steep rise. Likewise, falling inflation now has a lot to do with falling oil and food prices.

Figure 2. Iran’s inflation rate is also aligned with oil and food prices

Note: Iran’s inflation in based on the urban CPI published by the Central Bank of Iran.

What does it mean for policy to say that Iran’s inflation has external origins? Of course, it does not mean that internal reasons are not important or are of secondary importance. Clearly, the high last four years had a lot to do with the energy price reform, stifled inflation due to financial repression and overvaluation of rial in the previous ten years, as well as international sanctions. Some of blame for high inflation of the recent past should surely go to bad polices of the Ahmadinejad administration, chief among them the financing of cash transfers and public housing by borrowing form the Central Bank. But putting all the blame on the growth of money supply, as many pundits in Iran do, is to ignore the part due to external factors, themselves related to the reality of rigid prices. A partial diagnosis of the past inflation means that the country is vulnerable to future external inflationary shocks.

The lesson to draw from looking at external factors is to realize that in the face of rising global oil and food prices, fighting inflation can be costly in terms of jobs. Yes, the Central Bank can keep liquidity from increasing, and force a real appreciation through decrease in tradable prices, but the deflationary pressure needed to do so will do serious harm to the economy. Monetary policy would have a hard time stopping wages from rising as food prices rise and rising government expenditure of oil revenues increase demand for labor. This unfortunate scenario will continue to repeat itself as long as the source of economic growth in Iran is rising price of oil instead of productivity.

Unless we draw the right lessons from past experience, we will not be ready when food and oil prices rise again — perhaps several years from now — and the scenario of the last decade will play again. Despite rising food prices and wages, Iran’s exchange rate would stay the same because there would be no compelling reason to devalue the rial when foreign exchange is pouring in. Domestic production becomes less competitive, setting the stage for another round of inflation when the overvalued rial is no longer sustainable. The currency will collapse and prices shoot up. Who and what will get the blame that time around?

Einsortiert unter:Economy, Inflation, Iran Hassan Rouhani, Wirtschaft Tagged: Economy, Inflation, Iran, Wirtschaft